This story is part of The Next New Deal, a series examining the coronavirus economic recovery.

Part 1: The original New Deal

Part 2: The worker

Part 3: The environment

Trina Traylor spent much of Juneteenth handing out groceries to her South Los Angeles neighbors in need. “It was a wonderful event,” she told me a few days after her team handed out food to more than 500 families. “People were so appreciative.”

But Traylor expressed a nagging frustration that the food drive, organized by the Los Angeles Black Worker Center, was necessary at all. Food insecurity here, unfortunately, is nothing new — particularly among a Black community grappling with unemployment, homelessness, and low-wage jobs in one of the nation’s most expensive cities. But the COVID-19 pandemic has brought a new level of need. Traylor said she sees food drives almost daily now. “And when you go, you see people of color. That’s all you see.”

As an LABWC volunteer and an organizer with the Service Employees International Union Local 2015, Traylor sees the full spectrum of coronavirus inequities during this pandemic job crisis. Low-wage workers, many of them people of color, are either unemployed or forced to work in public-facing jobs deemed essential. That’s been the case for her union members working in nursing homes, which have been particularly hard-hit by COVID-19.

“Most of white America, they’re working from home,” she said. “We don’t have that luxury.”

The economic crisis driving folks to the bread lines is being experienced by workers throughout the West. A fundamental problem is that jobs in the modern economy often pay too little for a person to meet their basic needs; the United Way estimates 40 percent of American households were one crisis away from financial ruin before the pandemic. The workers who hold these jobs lack access to adequate health care, and they’re likely to live in neighborhoods without robust options for food, child care, or transportation. It’s a problem that predates the coronavirus, one now putting workers — especially in communities of color — at unprecedented levels of risk.

“All of these things created a perfect storm for Black people,” Lola Smallwood Cuevas, a project director at the University of California, Los Angeles Labor Center and founder of the LABWC, told me. “What was already weak just got rocked by COVID-19.”

Fixing our nation’s relationship with work and labor, both during and after the pandemic, is going to be a long and multi-step process. The first is to keep employees economically and physically safe until a vaccine is developed. A bill introduced by Washington Representative Pramila Jayapal, modeled after countries that have been far more successful than the U.S. at containing COVID-19, would go a long way to that end.

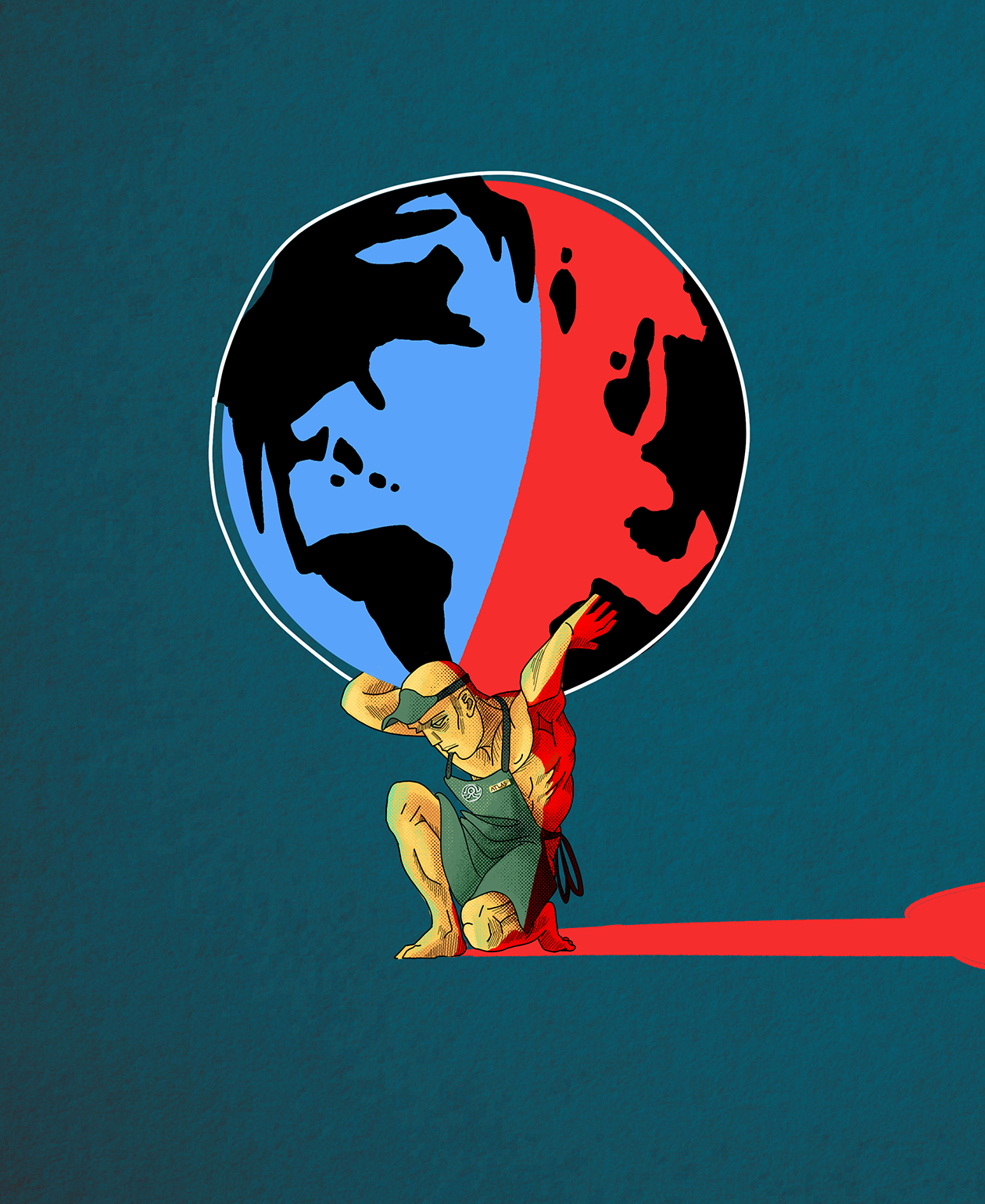

But to build resiliency among working families, structural changes inspired by the New Deal policies of the Great Depression could be necessary, especially if unemployment remains high. President Franklin Delano Roosevelt’s stimulus packages of the 1930s didn’t just bring us new dams and bridges — they hastened the country’s economic recovery by getting money directly to workers, and preceded a period of more equitable wealth distribution.

Our modern problem is systemic, and will require wide-ranging fixes. But at the heart of a jobs crisis is, indeed, the lack of well-paying jobs. Solving it might require the government to create some.

In March and April, Congress scurried with rare bipartisan speed to pass bills directing some $3 trillion to coronavirus relief. A large portion of that — $1.85 trillion — went to businesses in the hope they would keep their employees on the payroll. Nonetheless, unemployment surged. By April, when coronavirus-related furloughs and layoffs reached their peak (so far), more than 38.2 million people had lost their jobs. The unemployment rate, 14.7 percent, was higher than anything seen since the Great Depression. Employers added some jobs back in May, but the Congressional Budget Office predicts unemployment will hover above 9 percent through 2021.

As far as Pramila Jayapal is concerned, a huge chunk of those job losses could have been avoided. In May, the Washington Democrat introduced the Paycheck Recovery Act, which would have the federal government cover compensation up to $90,000 for employees of eligible businesses, nonprofits, and state and local governments. Organizations would also get help with operating costs, and the program would automatically renew until the national unemployment rate remained below 7 percent for three months.

“It is both an economic plan and a health care plan,” Jayapal told me in an interview. “If we’re going to beat the virus, we need to keep people home. If we want to keep people home, we’ve got to make sure they have money in their pockets.”

Our journalism is possible only with reader support. Contribute to Bitterroot today.

How Congress responds to the coronavirus will have lasting economic implications. Sociologist Megan Tobias Neely points to the difference in our recoveries from the Great Depression of the 1930s and the late-2000s Great Recession. In the Recession, she explained, stimulus funds were funneled through banks and big corporations, which stashed the money or used it to buy back their own shares on the cheap. On the other hand, New Deal policies implemented by Roosevelt prioritized labor over capital.

“In the New Deal, the focus was on employing as much of the population as possible,” Tobias Neely, a Stanford University postdoctoral researcher and co-author of Divested: Inequality in the Age of Finance, told me. Sure, we’re familiar with the grand public works projects, but Tobias Neely said keeping folks like artists and teachers employed was equally important. “It was a much more well-rounded, comprehensive, community look at how to sustain society as a whole. I think that’s an important message for today.”

The New Deal ethos of quickly getting money to workers is behind Jayapal’s legislation. With coronavirus cases still on the rise, she said, economic stability is the priority; after all, a restaurant that opens up today could close again in two weeks. A paycheck guarantee would allow the broader economy to flex as the coronavirus dictates without sending massive amounts of workers and small-business owners into economic calamity.

Jayapal’s bill quickly gained 102 co-sponsors, and Republican Josh Hawley of Missouri floated a similar idea in the Senate. But the bill has, thus far, gone nowhere. The $3 trillion relief measure passed by the House in May didn’t include a paycheck guarantee provision.

As the U.S. economy improved following the Depression, people’s incomes grew at the same rate whether they were at the top or bottom of the pay scale. If a company’s profits went up, it was likely that both the CEO and the frontline factory worker got a raise. But that began to change in the 1980s.

“Our society has transformed into one where finance is at the center of our economy,” Tobias Neely, also an assistant professor at the Copenhagen Business School, said. “Because of that, it has completely changed the relationship between shareholders, executives, and workers.”

Anti-union laws have watered down workers’ collective bargaining power, and companies have kept wages relatively flat for decades. Firms these days are quick to downsize their workforce, and we’ve witnessed the growth of on-demand labor performed by independent contractors like Uber drivers. From 1980 on, incomes for the top 1 percent of earners grew five times faster than for the middle 60 percent; those folks at the top now possess more than 40 percent of the nation’s wealth. All told, “it creates a more unstable society,” Tobias Neely said.

Traylor witnessed that instability in South Los Angeles. Growing up in the 1970s and ’80s, she said, there was a thriving Black middle class. Family members worked public-sector jobs that paid enough for them to buy homes on their own, while other folks landed union jobs in the city’s robust manufacturing sector. But in the 1980s, car companies began moving production out of Los Angeles to regions where labor was less expensive. Corporate share prices jumped, but jobs evaporated, and with them went the tax base. The heyday of Los Angeles’ Black middle class, preceded by centuries of legal discrimination, lasted less than two decades.

Discussions of American financial instability often focus on those who earn about $2,000 a month or less for a family of four — the federal government’s benchmark for poverty. But it’s obvious that incomes well above that threshold still yield a life of insecurity.

Researchers with the United Way coined a term, ALICE (asset limited, income constrained, employed), for just such workers. These folks have jobs, but their incomes are low enough that one or two missed paychecks could spiral them into financial ruin. And the number of households that fall under this category is incredibly high. Among Western states, the share of sub-ALICE households exceeds 40 percent in New Mexico, California, Oregon, Nevada, Arizona, and Idaho.

Consider the situation in Oregon, where, according to the United Way, a family of four must bring home more than $6,300 per month to live comfortably — triple the federal poverty line. Despite robust economic growth after the Great Recession, 44 percent of households here were struggling to meet their monthly costs in 2018, up from 32 percent in 2007. Wage increases over that period didn’t keep pace with the rising cost of living. Many jobs added since the Recession are low-wage positions with unreliable hours, unpredictable scheduling, shoddy benefits, and no potential for wealth creation.

“The position of many workers in Oregon has been eroding despite the economic recovery since the Recession,” said Janet Bauer, a policy analyst at the Oregon Center for Public Policy and a member of the Northwest ALICE research committee. “These are trends that are worrisome, and really call for strengthening our structures so workers are faring better and participating in the fruits of the economy.”

Folks in ALICE households overwhelmingly work jobs deemed essential during the pandemic — bus drivers, cashiers, farmworkers — or in the retail and hospitality sectors that have been decimated. Systemic racism and sexism shows up in the stats, too. In Oregon, nearly 8 in 10 households headed by single women earn below the ALICE threshold; the figure is two-thirds for Black households, and 60 percent for Hispanic-led ones.

Extrapolate those trends to the entire nation, and the COVID-19 damage follows a logical path. Native Americans and Black people are dying of COVID-19 at disproportionate rates. People of color and women are most affected by job losses — 21 percent of Hispanic women lost their jobs during the outbreak.

This dynamic frustrates Jayapal. An Indian immigrant, she spent decades working with public health and immigration organizations before being elected to Congress. Since taking office in 2017, she has authored legislation aimed at helping low-wage workers, immigrants, and LGBTQ people. One of her driving principles, she told me, was to re-establish the dignity of work.

“Whether you’re a bricklayer or warehouse worker or grocery store clerk — that is work that is essential to our economy,” Jayapal said. “You should be paid a living wage, and you should have the benefits that allow you to put a roof over your head, put food on the table, put your kids through college, and retire with dignity.”

Lifting wages could improve the standard of living for all. In Oregon, for instance, the United Way estimates that boosting every worker’s pay above the ALICE threshold would pump $58.2 billion a year into the state economy — a whopping 24 percent increase in gross domestic product. And the benefits to family units compound: A parent who can adequately raise her family on a single salary has greater capacity for time with children, self care, education, cooking, and numerous other activities that reduce stress and improve quality of life.

Chronically low wages and unemployment are “counterproductive, and something we shouldn’t tolerate,” Bauer said. “We live in a consumer-oriented economy, and we limit ourselves when people don’t have the resources to go out and meet their basic needs.”

So — how do we fix it?

First, the pandemic. If the goal is to keep the virus at bay and folks on payrolls, Jayapal’s idea has a proven track record (when coupled with adequate testing and contact tracing). Workers in Denmark, Singapore, and South Korea were able to stay at home in relative financial comfort thanks to a paycheck guarantee, and these countries quickly stemmed the virus’ lethality. As I write this, the coronavirus death rate in the U.S. is 37.1 per 100,000 residents, and will certainly be higher by the time you read it. In Denmark, the figure is 10.4; South Korea and Singapore have experienced around 0.5 deaths per 100,000 residents.

A paycheck guarantee would cost trillions, but our current approach has resulted in the loss of more than 120,000 lives. Value each death at $10 million — the figure the feds use when crafting policy — and we’ve already lost at least $1.2 trillion in human life. In addition, the Federal Reserve predicts our economy will shed more than $1.3 trillion in GDP by the end of the year. The cost of inaction is incredibly steep.

Improving the broader labor situation is a task that will extend beyond the pandemic. Such a systemic issue will require a broad range of solutions. Bauer said a boost to the minimum wage and an expansion of the earned income tax credit would add thousands of dollars to workers’ wallets each year. For Jayapal, universal health coverage — she’s a co-sponsor of the Medicare for All bill — and comprehensive immigration reform are necessary. Given that so much of the work we now deem essential is done by immigrants, Jayapal said, it’s critical that they receive a path to citizenship.

“If you eat food, immigrants have picked it, processed it, put it on your table, maybe delivered it to your door. Our home care industry and our health care industry are fueled by immigrant workers,” she said. “This is part and parcel to stopping the distinction between essential and expendable. You can’t be both at the same time.”

But truly solving a jobs crisis has to get at the jobs themselves. FDR called for a federal jobs guarantee, as did Dr. Martin Luther King Jr. near the end of his life. Marriner Eccles, the Federal Reserve chair who was a key player in crafting the New Deal, argued that it was the federal government’s responsibility to create jobs in events of mass unemployment. “Why shouldn’t we declare as a national policy that we will, collectively, through government, offer the security of a job to all who are able and willing to work but are unable to find private employment?” he asked a New York audience in 1940. “Why not provide assurance of employment, not merely insurance for unemployment?”

One proposal in the New Deal mold, put forth by the Center on Budget and Policy Priorities, would create a National Investment Employment Corps to provide a job for any American adult who wants one. Much like the New Deal programs of old, NIEC would focus on public works projects at the behest of state and local partners. Pay would start at $11.83 per hour — well below ALICE thresholds in many states, but higher than the current $7.25 federal minimum — plus benefits. The program, CBPP estimates, would cost $543 billion a year. It’s a huge sum, but ending unemployment and eliminating poverty wages would cost about $180 billion less than the country spends on the military each year.

“Workers are faced with stagnating real wages and a continued erosion of labor’s share of income,” the proposal reads. “The job guarantee could significantly alter the current power dynamics between labor and capital — particularly for low-wage workers and traditionally marginalized groups.” Further, the cost of the program would be offset by “increases in local, state, and federal tax revenues, decreases in uptake of existing social insurance programs, increases in the growth rate of GDP, and substantial productivity and capacity gains in the U.S. economy.”

With federal funding, jobs programs could take shape at the local level, and correct some of the imbalances experienced by people of color. Households that fall below the United Way’s ALICE thresholds spend disproportionate amounts of their income on health care, housing, and transportation. In Los Angeles alone, a federally funded jobs program could put people to work establishing clearly-needed public health networks in the neighborhoods most affected by COVID-19. They could build the 517,000 affordable rental units needed in the county, and rail lines in transit-starved neighborhoods.

“Our communities are in such need of infrastructure development, from sidewalks to rail systems to our schools and parks,” Smallwood Cuevas said. “The key here is we have to use measures to create equity mandates.” That could soon be easier in California, where voters in November will decide whether to repeal the state ban on affirmative action.

Traylor sees potential in such programs, too. Her Juneteenth food drive was held off Crenshaw Boulevard, where the city of Los Angeles is building a new light-rail line. It took pressure from the LABWC before the city added Black workers and contractors to the project, but Traylor sees a future in which public works projects are built by the very community members who will put them to use.

“I cannot say enough about public sector jobs,” Traylor said. “That is how we restart the Black middle class.”